us japan tax treaty withholding rate

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. Most treaties explicitly provide for higher WHT on royalties in excess of FMV in non-arms-length circumstances.

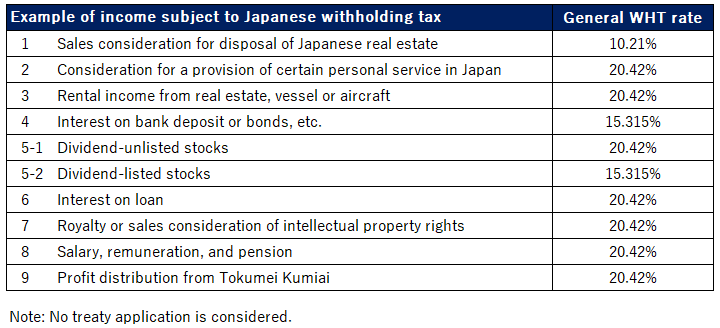

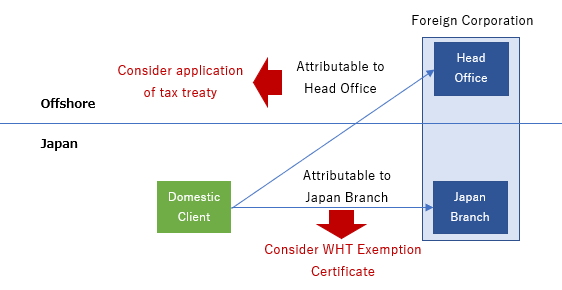

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

In most jurisdictions tax withholding applies to employment income.

. A zero rate of tax may apply in certain cases. The tax is thus withheld or deducted from the income due to the recipient. The treaty has been signed but is not yet in force.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. 0 or 275 0 or 25 or 275 0. Summary of US tax treaty benefits.

0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer. In the absence of a treaty Canada imposes a maximum WHT rate of 25 on dividends interest and royalties. Tax withholding also known as tax retention Pay-as-You-Go Pay-as-You-Earn or a Prélèvement à la source is income tax paid to the government by the payer of the income rather than by the recipient of the income.

30 10 30 Note there are certain exemptions that may apply Austria Last reviewed 11 January 2022 Resident. 0 or 275 0 0 or 20.

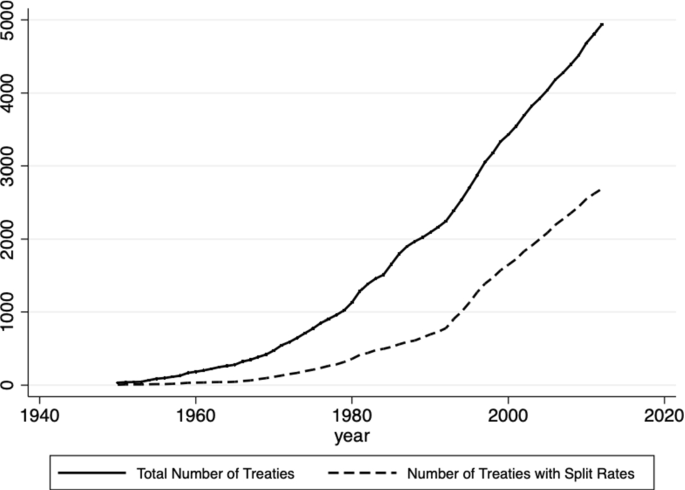

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

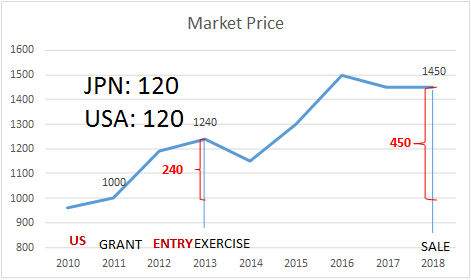

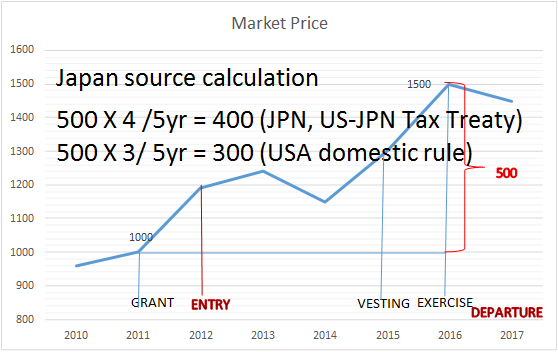

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

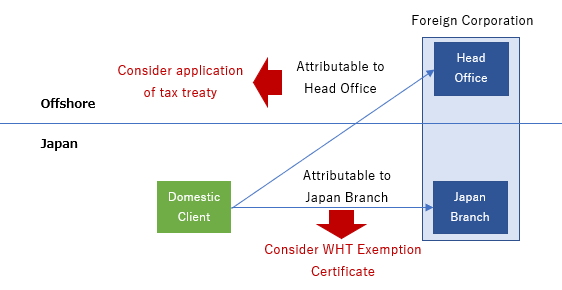

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office